Depreciation expense formula

The purchase price of these hypothetical forklifts is 7000 apiece for a. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation expense is that portion of a fixed asset that has been considered consumed in the current period.

. For example an asset with a useful life of five years would have a reciprocal value of 15 or 20. Asset cost - salvage valueestimated units over assets life x actual units made. The intent of this.

Annual Depreciation Expense Cost of the Asset Salvage Value Useful Life of the Asset. You buy a car for 50000. DDB Net Book Value - Salvage Value x 2 Useful Life x Depreciation Rate.

Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase. Start with the cost of an asset and multiply by the number of units. This amount is then charged to expense.

The formula is as followed. Using the straight-line method of depreciation the depreciation expense to be reported on each of the companys monthly income statements is 1000 480000 divided by 480 months. Depreciation Expense 17000 - 2000 5 3000.

Depreciation Original cost Residual Value x. Following the depreciation expense formula above. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Lets use a car for an example. Unit depreciation expense formula fair value residual value useful life in units How To Calculate Depreciation Expense The straight-line depreciation technique can be used to. Example of a Depreciation Expense.

Annual Depreciation Expense 8000 1000 7 years. Depreciation Expense Beginning Book Value for Year 2 Useful Life. Unit Depreciation Expense Fair Value Residual Value Useful Life in Units Periodic Depreciation Expense Unit Depreciation Expense Units Produced For example.

Depreciation expense 2 x Assets book value x Depreciation percentage Unit of production method The unit of production method calculates the depreciation based on the. It has a useful. The depreciation rate 15 02 20.

Depreciation x Actual output during the year units Sum of Years of Digits method It is a variant of the diminishing balance method. If the machines life expectancy is 20 years and its salvage value is 15000 in the straight-line depreciation method the depreciation expense is 4750 110000 15000. 25000 - 50050000 x 5000 2450.

To determine the depreciation expense they would subtract the residual value from the initial value of the asset and then divide that number by the number of units they expect to. Now you can build a depreciation scheduleThe depreciation schedule for.

Depreciation Expense Double Entry Bookkeeping

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

Double Declining Balance Depreciation Daily Business

Depreciation Formula Examples With Excel Template

Annual Depreciation Of A New Car Find The Future Value Youtube

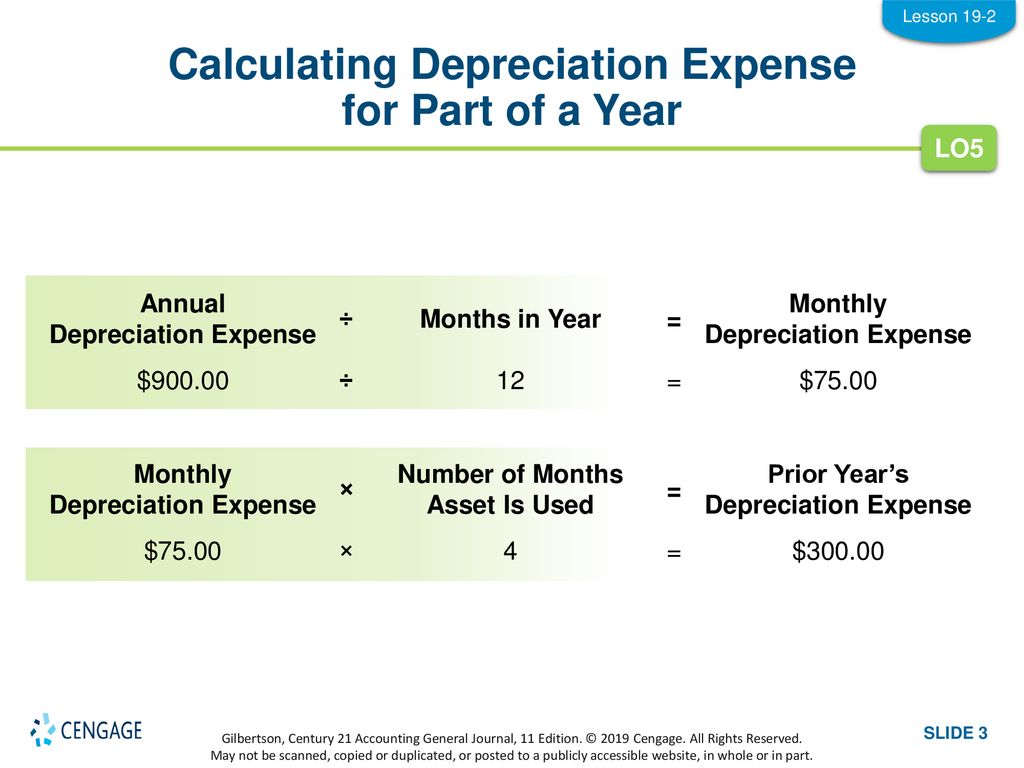

Lesson 19 2 Calculating Depreciation Expense Ppt Download

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Schedule Formula And Calculator

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Formula And Calculator

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation

Accumulated Depreciation Definition Formula Calculation